10 years passive returns... Is it worth being more active?

Dear Reader,

I had a brilliant idea once that if I just bought the worst performing index out of a basket of 10 on the first of January each year and sold it the following year I couldn't fail to make money. It is actually true, if I can find the spreadsheet I put together i will stick it on here. I was going to call it 'Don's Trade once year and make money' fund. Not very catchy really but I was going to try and prove a point.

Anyway I thought I should show you what passive investing over a 10 year period in a few indices will do for your investment portfolio. To this end I have knocked up a handy chart here. The prices were taken from the opening market on Jan 1st of each year (yahoo finance).

If you have been following anything I have been writing you will recall I have developed an aversion to Japan. The chart above would imply that actually is the wrong approach but to be honest who could have predicted a 52% gain in 2014. I maintain I think it will lag behind its peers in the medium term.

The Eurostoxx 50 is the sick puppy here. To be honest if I had stuck 100k in a Eurostoxx tracker and after 10 years it was only worth 122990 I would be little upset.

I put the Swedish OMX in just as an outlier to show how non core seems to do ok as well (only really because I had Swedish meatballs for supper last night). If you strip out the 42% gain in 2010 it also looks like a slightly aenemic return for non core risk.

I constantly see the MSM harping on about 'if you had invested in a S and P tracker over term you would have made 9% per year' It is actually higher than that. However what fun is it really just to leave your money sitting in one investment?

To put these 'passive' returns in perspective we can compare against a few funds. Place your bets ladies and gentlemen. A lot don't have 10 year track records so we can just reference it against each individual year's performance.

Fundsmith blows passive away. Apart from the fact Terry never bought a round of drinks in my memory when he was at Tullett he clearly knows how to stock pick. Cannot recommend him highly enough.

Lindsell Train is another stonker of a fund giving an average annual return over 5 years of 22%.

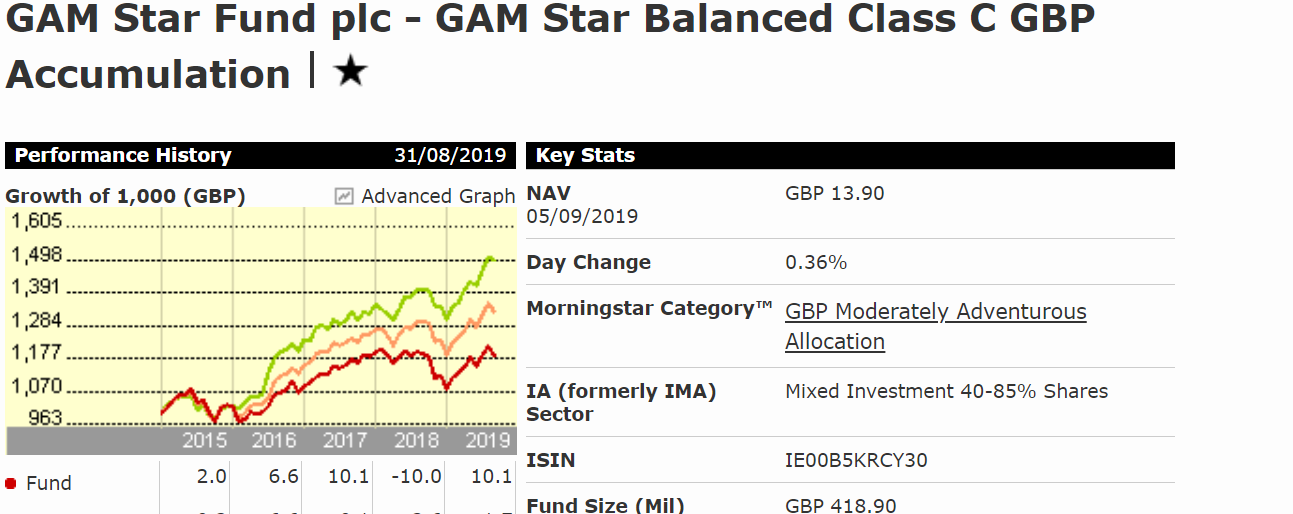

Another favourite of the wealth management industry is multi asset funds. You get to spread your investment across a wide basket of investments. I equate it to trying to butter your bread with the last bit of butter in the tub. It looks like its buttered but we all know its a bit thin and leaves a dry taste in your mouth. If you had bought GAM over a 5 year period you would have an average return of 3.52% and annual charges of 2.87%. As my granny used to say complete mince.

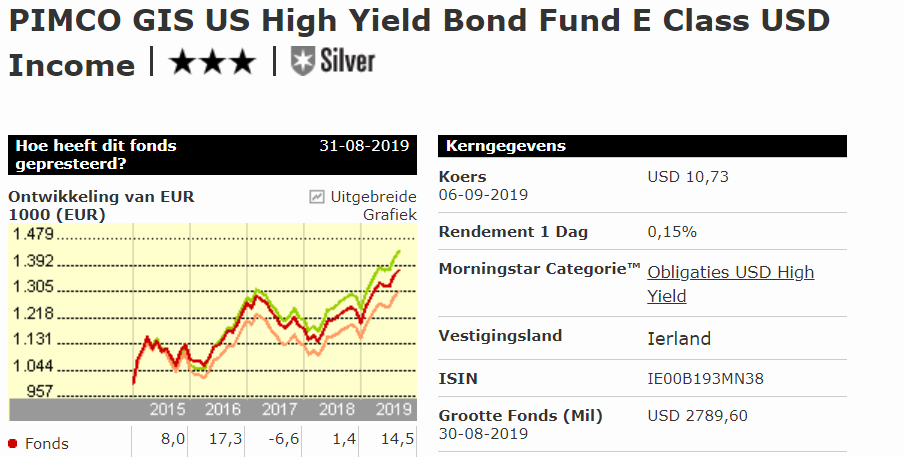

For good order I have stuck bond fund in here as well as I wouldn't like to be accused of being too equity focussed even though we are discussing 'passive' vs 'active equity. It does ok but I wouldn't expect it to outperform indices over time although it does beat GAM multiasset with a 5 year average return of 7.73%. Also apologies for the paste being in dutch I am not sure what Hoe heeft dit bonds means but I am sure it is exciting.

I think being active is a far better approach than passive short medium and long term. Ask anyone who has bought a structured note linked to the eurostoxx in the last 4 years if they are enjoying that investment. Holding an S and P etf is a great call for USD exposure with cheap entry but I would say only as part of a diversifed portfolio. As ever it is about picking a basket of strong funds and keeping an active eye on them.

That's it. It is a grey and chilly start to the weekend here in the UK and I have just had some bloke called Jon Snow turn up at the door bleating about winter coming. Have a great weekend I'm off out on the bike.

Don 'need to be more active' King