5,500 times oversubscribed? That is a big bond bubble

Dear Reader,

I am an avid fan of Science Fiction both written and film works. If any of you haven't read Frank Herbert's Dune I heartily recommend it. There is a line in the film adaptation of it which I use in abstract a lot 'The Spice must flow'.

Money has a habit of flowing to where it will find value. That means that whichever space that money is in will be very crowded. If you haven't read my previous article on IPO's I attach it here below. I think given the resulting collapse of WEwork it is still very much worth a read.

This brings me to today's eye cast on the world of Chinese convertible bond issuance. It is a relatively 'small' market with 40 billion USD issued this year - this is up 80% from last year and this fact alone makes it worth checking out.

The reason why they are so attractive to investors is that they are treated as debt until they are converted meaning that in the case of the company going bust the investors effectively jump the queue for some form of settlement.

This Chinese market seems to be like the IPO market on crack. When Shanghai Pudong Development Bank sold $7 billion in convertible bonds last month there was more than 1 trillion dollars of subscription orders. 140 times oversubscribed. That is insane.

It completely pales into comparison when you think the largest issuance on record of nearly $6bn, from China Citic Bank, was about 5,500 times oversubscribed. That means, if you believe the stories from Chinese press, that there were 33 trillion dollars of orders for the bond. That is 2.7 times the entire 2017 GDP of the Chinese economy.

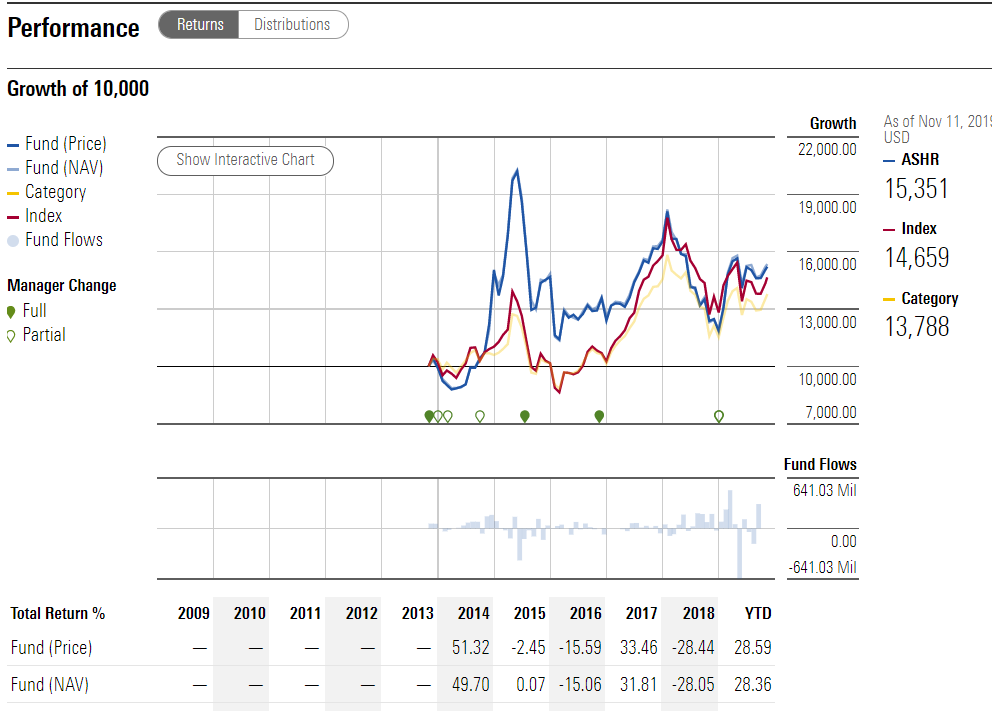

Obviously this is a market for locals and experts. Being a slightly jaded old trader I tend to stay away from things I don't fully understand. If you are looking for opportunistic investments in China with at least a decent level of liquidity you could consider Xtrackers Harvest CSI 300 China ETF. There is 1.7 billion in the fund.

I picked this one at random as I have it in some portfolios already but there are many others that would give some exposure if you fancy a flutter on the deal. Link below.

https://etfdb.com/etfdb-category/china-equities/

Anyway the day beckons and Dodger the rescue Beagle is whining to go out for his morning constitutional. I leave you with the thought that Kyle Maclachlan was much better in Twin Peaks and Blue Velvet and can anyone tell me why Morningstar's code writing team have changed their websites again causing all my spreadsheets to need reformatting yet again?

Best

Don 'Tell me about your home planet Muad'Dib' King