Beep Beep Beep Beep How do we turn this monster truck around?

Dear Reader,

I had a thought this morning about the current state of play in planet printathon. Central banks are playing blackjack while drunk and seem to keep twisting incessantly (printing more and more) to try and stay at the table. The idea that printing ever more fiat currency as a mechanism to 'sort your problems out' wont end badly is at best laughable and at worst tragic.

I am reminded of an articulated truck that has driven up a one way cul de sac. There is no way out and reversing is going to be an extremely difficult operation. The big problem with using printing money as your only strategy is that every time you do it you will need to do more and more to get the same effect- rather like a heroin addict shooting up. The money supply is off the charts and shows no sign of stopping.

I have written before about the phenomenon coined by Ludwig von Mises 'Crack up Boom' or Katastrophenhausse. This from the Ludwig von Mises institute

'Hyperinflation is perhaps the darkest side of a government fiat money regime. Among mainstream economists, hyperinflation typically denotes a period of exceptionally strong increases in overall prices of goods and services, thus denoting a period of exceptionally strong erosions in the exchange value of money.

Economically speaking, hyperinflation is the inevitable consequence of an ever-greater rise in the amount of money. And this is exactly what the monetary theory of the Austrian School of economics teaches: In fact, Austrian theory shows that inflation is the logical consequence of a rise in the money supply, and that hyperinflation is the logical outcome of ever-higher growth rates in the money supply. '

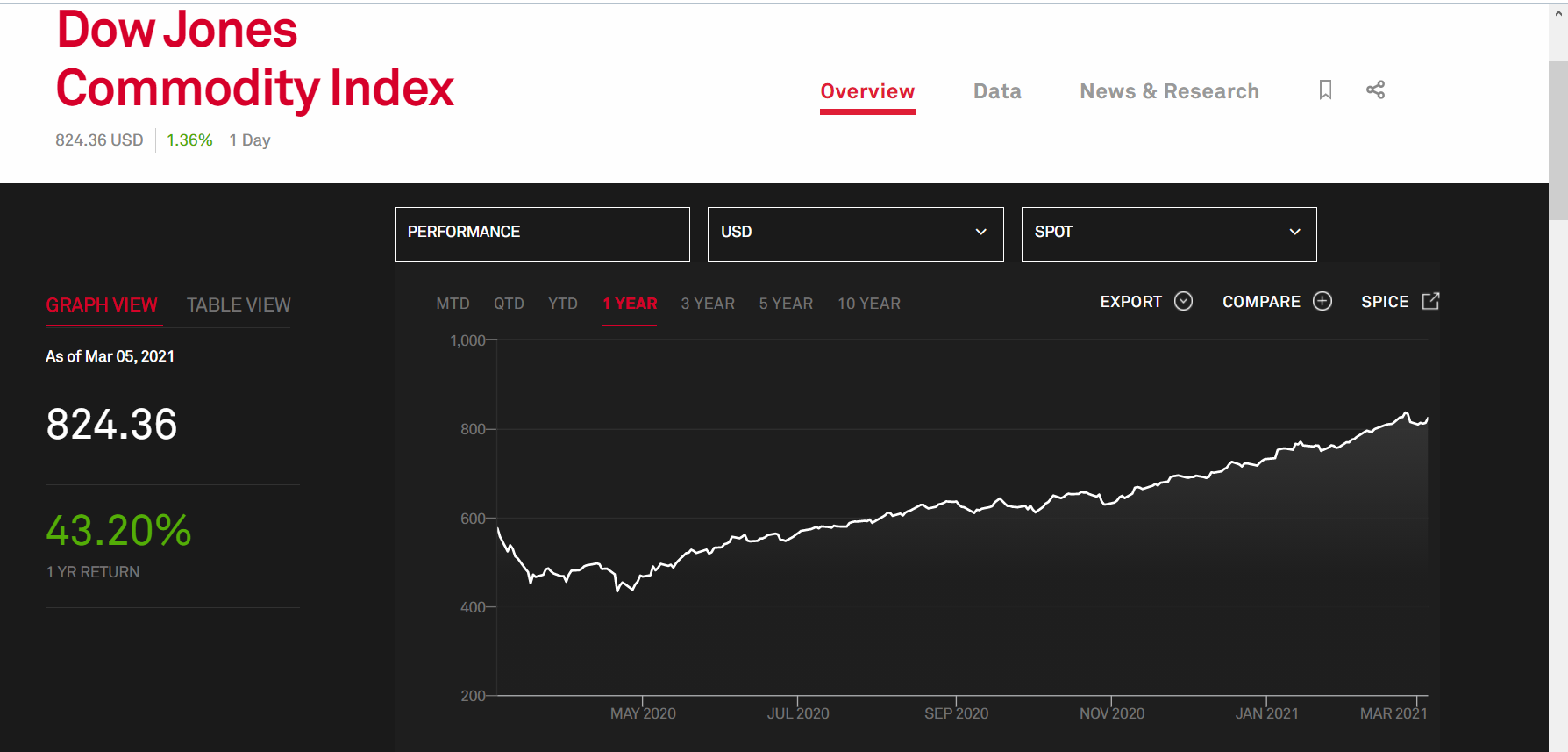

We are already starting to see rampant inflation in commodities which will in turn lead to higher prices for end consumers.

The big issue as an investor is that all fiat currencies are in the same boat. If you listen carefully you can almost hear the brrrrrrrrrrrrr of the printing presses as I write this. This is the main reason I turned my focus to accumulating first precious metals then Crypto assets last year.

I see no reason why Crypto will not effectively become a digital safe haven as Central bankers continue to drive their fiscal trucks down the cul de sac with no exit strategy. My advice would be to have some exposure in this arena.

Have a great week ahead and faites vos jeux mesdames et messieurs

Don 'Twist' King