Commodity funds bad - tactical investments in commodity shortages good

Dear Reader,

In my last scribble on market overviews I said that I am considering a punt on wheat based on my conversations with UK farmers. I drove past fields last week with wheat still in them so that reaffirms their view that we are likely to head towards supply issues.

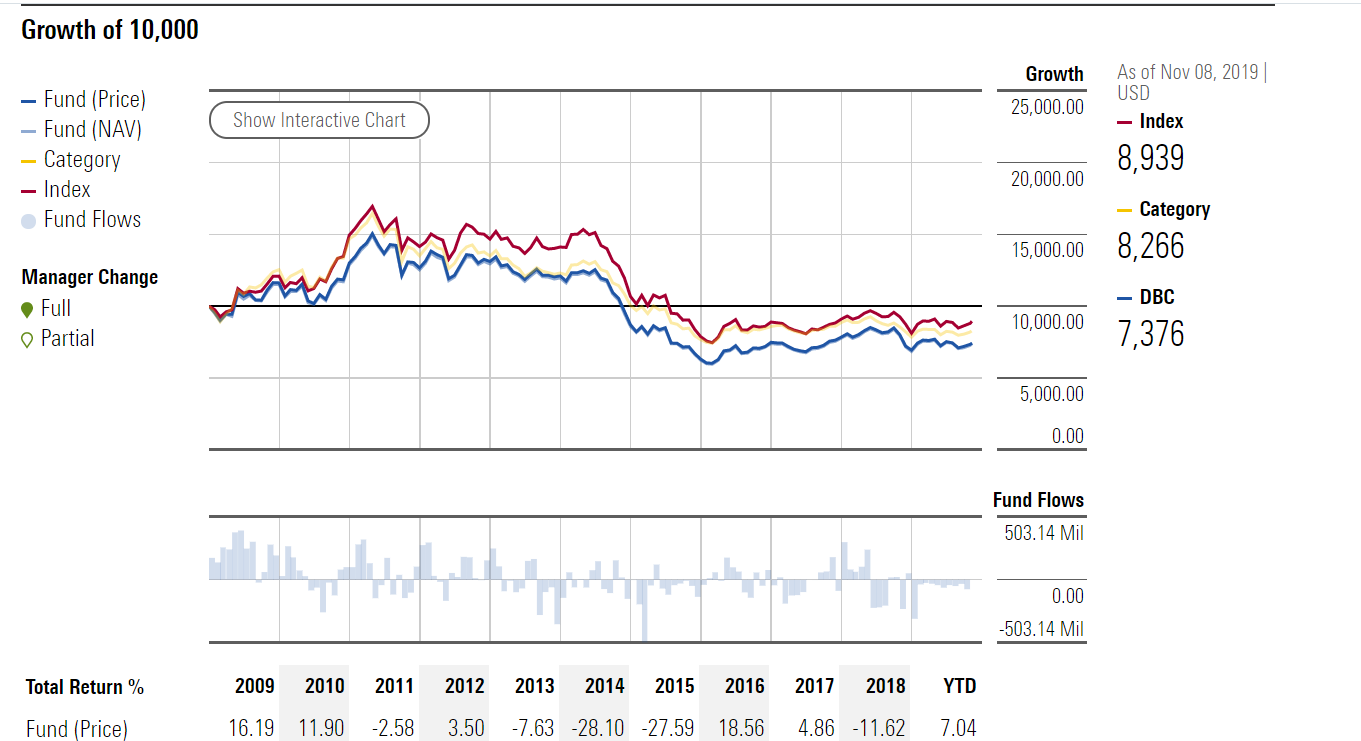

Part of the fun of building portfolios for clients is when they decide to have a small percentage of it to invest opportunistically. I started looking at commodity funds recently with that view in mind and if I am honest they don't really seem to offer much of a decent punt to me relative to the sort of funds I tend to choose.

Below is the historical performance for Invesco's DB commodity tracking fund. It is above average risk. Lets be honest you would have made more money just going long physical gold this year.

So far in my travels through the world of commodities I havent found one fund that would fit my investing metric. Will keep you posted.

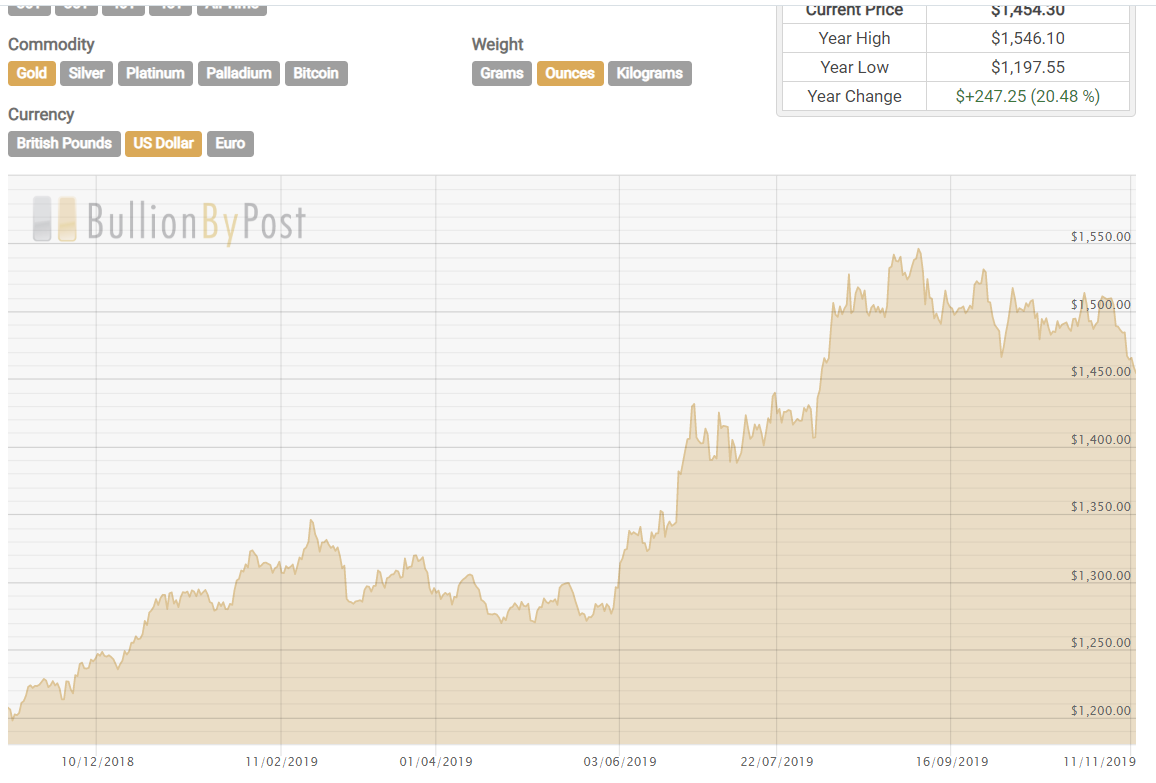

To highlight this mismatch between individual commodites vs funds here is a chart for Gold over 1 year. If you had just invested in rolling CFD's or even physical you would have gained 21%.

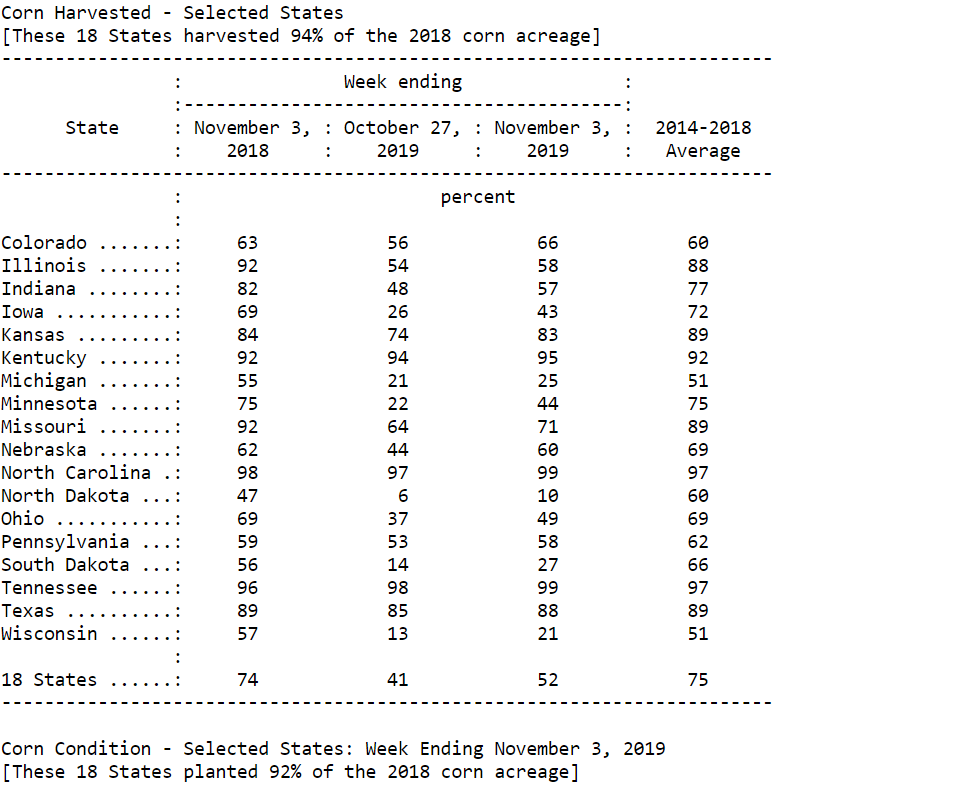

This is just a short note today as I wanted to highlight that this doesnt seem to be just a UK issue. I came across some data from the USDA released on the 4th of November.

here is the link to the data

Just seems to be some sort of opportunity there.

Have a superb day out there

Don @wheaty' King