I always liked the Pet Shop Boys - Not sure about their investment advice though

Dear Reader,

I wonder how many of you non UK residents have financial advisers. Those that do I wonder if you know what they are charging you for helping manage your finances.

I wanted to talk a little today about fees. There is a market convention among IFA's and tied agents (those that work for one specific company and can only offer their products) that clients should be charged in the region of 1% per year to get access to services. Generally speaking most advisory firms seem to offer quarterly reviews for customers where they can go through portfolio performance and look at tweaking things depending on changes in client's circumstances.

If we look at St James Place the UK advisory firm. The Times seems to have a chip on its shoulder about its fees (I am guessing a disgruntled reporter thinks he has had his eyes out by them in the past).

https://www.thetimes.co.uk/article/secret-dossier-leaks-st-jamess-place-sales-tactics-s389shlbc

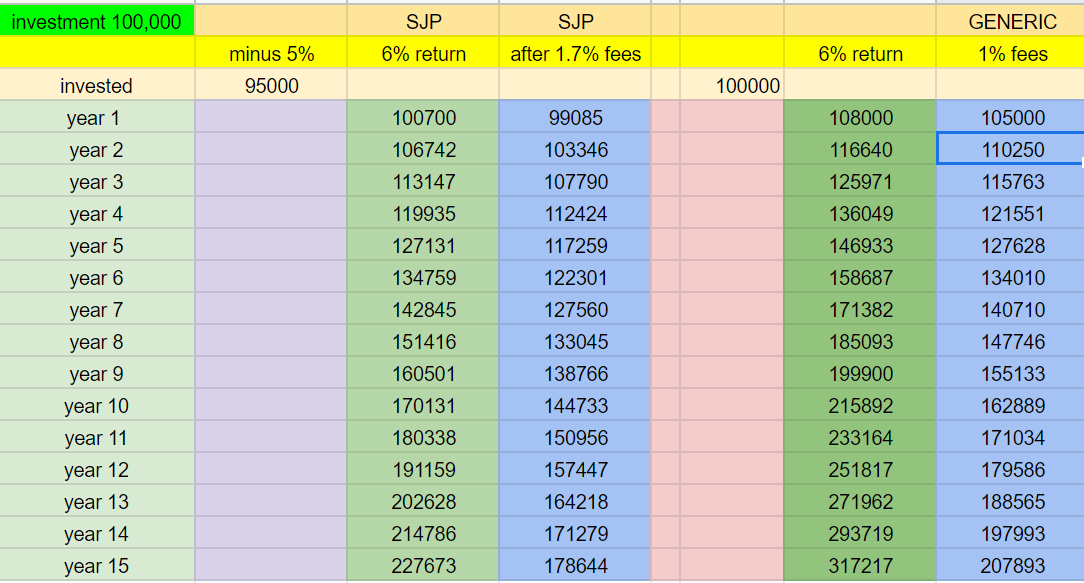

They seem to have adopted the reassuringly expensive approach to being advisers charging 5% upfront fees, 0.5% ongoing annual advice and 1.2% annual management to be in their SJP fund. I have handily knocked up a nifty spreadsheet to show you the effect of this on the growth of your capital over time. The left hand columns show the returns you could expect to get from SJP after charges and the right hand indicate how you would expect to do without having such high entry and ongoing fees. There is nearly a 17% difference in returns over time.

SJP only sells its own products and has around 109,000,000,000 pounds under management. Blimey that is a well oiled machine. Imagine they took 5.5 billion in initial fees and are taking in 1.85 billion in annual fees.

This from Yodelar who reviewed them in march this year so I don't have to.

- Less than 2% of St. James's Place funds have maintained top performance over the past 1, 3 & 5-years.

- 79% of their unit trust funds performed worse than half of their same sector peers during the last 5-years.

- More than 70% of client money under their management is held in underperforming funds.

https://www.yodelar.com/insights/st-jamess-place-review

Others in the International arena have a similar setup. One very large one charges 4% entry and 1% ongoing. The KEY point for anyone considering using a wealth manager is to try and nail down these costs to give your funds the best chance of growth over time.

Most wealth managers will white label funds from fund managers as package them as their own. So when you are buying a risk profile 'off the shelf' package you are merely buying a blend of other funds with some more charges attached.

Here are a few of Don's handy hints to try and not get sold a costly dream.

1/ Ask them why they feel charging an initial upfront cost is realistic or justified.

2/ Check whether they are merely 'white labelling' fund managers funds as their own - you will end up paying twice for the same fund in annual management charges

3/ Ask if the Service charge/ Annual management charge can be waived

4/ Ask if there are exit fees should you wish to leave

5/ Check out their reviews online and ask for referrals

I do charge for my services but I am intimately involved in fund selection and constantly monitor the markets (blame the old trader in me). That said I do have clients that choose to select their own funds and in that case I cannot justify charging as they fall into the category of professional investors as a whole. For me there is no 'one size fits all' like St James Place. Perhaps I am missing a trick here but genuinely feel that I need to earn fees.

This is the bit where I rabbit on again about strategy. Active Macro - This is my approach to investing in funds and markets for clients (I might trademark it ). I only select bluechip funds with strong 3 year plus historical track records and over a certain AUM. If after 6 months they aren't performing to their historical metric I then make the decision whether to remain invested or to switch to better opportunities. I try and use institutional class funds as much as possible to lower costs. I also use currency and geographical location as trigger investment points. This is the bit where I earn my fees.

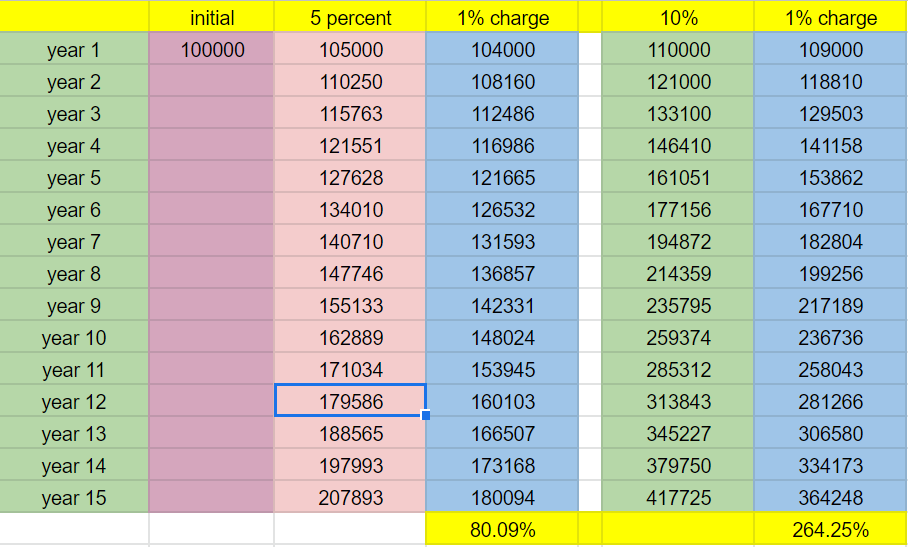

I expect to outperform indices with this approach and below you can see the effect on returns. Obviously these are not guaranteed but with focus and being agile in these choppy markets at least you are giving your money a fighting chance.

Anyway it is A level results day out there in the UK. Good luck to all parents and teenagers waiting feverishly to see if they made the grade for University.

I'm off to that there London for some meetings

Don