Like an obese Arnold Schwarzenegger - I'm back and looking at the markets

Dear Reader,

I heartily apologise for the absence in posting. I personally blame it on BREXIT but if I am honest I have been trying to recover from some form of Pig ebola brought on by eating too much bacon.

I hope you are all outstandingly well and starting to enjoy the Christmas period. Is it me or do the shops start promoting Christmas earlier each year? - I am pretty sure I saw the first advert back in October. Ho Ho Ho. I have already identified Mrs King's present (apparently she sadly doesn't want another cat) and now just need to find where I can buy one.

The markets in my absence have trundled on. The impeachment train seems to be running on fumes (dare I say it Barisma gas fumes). BREXIT may or may not be BREXIT and the Labour party is still promising free Unicorns plated in gold to anyone that votes for them. It is a bit weird when you step back from commentary for a while then start again - the news cycle is like an unceasing howling storm. It kind of feels like I have been sitting in a house with quadruple glazing and am only now stepping outside to be blown about a bit.

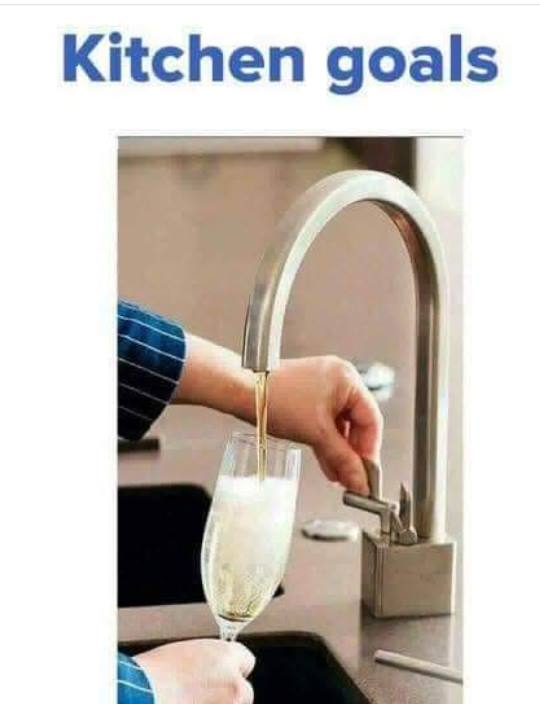

Lets have a shufty at the markets from my perspective. I maintain my overweight in USD centric funds and that is working well. God bless the Orange Swan I say. I see no reason why not to keep that focus given 'the deal' is still just around the corner (it is a very long corner). This China deal is like waiting for a bus - you spend ages waiting then about 4 will arrive at once.

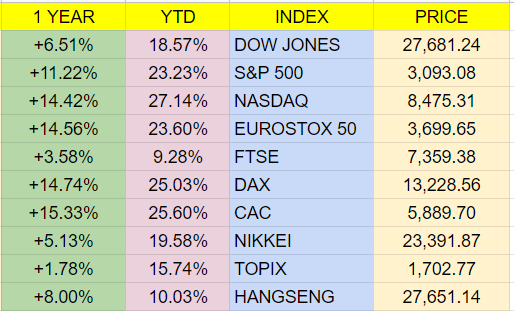

I spent Friday evening helping a very good friend build his portfolio. We both agreed that the UK may get a post BREXIT bounce and might be worth having some FTSE 100 ETF exposure as a cheapish way of getting some skin in the game. If you look above the FTSE is lagging its peers like a sad mate who has just broken up with his long term girlfriend out on a lads night out.

I like the look of Blackrock's FTSE ETF above given it has 8 Billion quid in it and has costs of only 7 basis points.

I cannot for the life of me understand the strong performance in the french CAC index and I do personally believe that the euro bloc has fundamental structural issues on the horizon. For that reason I am tending to shy away from over exposure in the region.

Japan year to date has done very well but over 12 months is still performing weakly. I remain unconvinced that it is a good sector to be in.

Also last night I made a point about being long cash. Generally speaking I hold around 10% in physical cash in portfolios which allows opportunity for buying in if markets come off. It struck me that there are clearly better options than doing that. As I repeatedly say leaving money sitting on a table is the worst thing you can do. I came up with the idea of using US Treasury etfs would be like having a liquid cash account with yield tacked on.

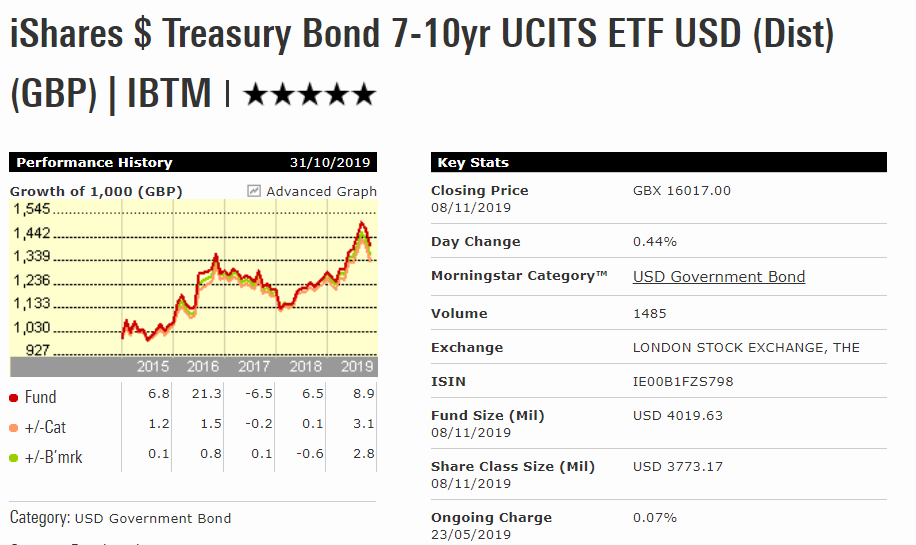

I like the Ishares 7-10 year etf above. It again has very cheap ongoing charges and is very liquid and actually has done pretty well over the last two years.

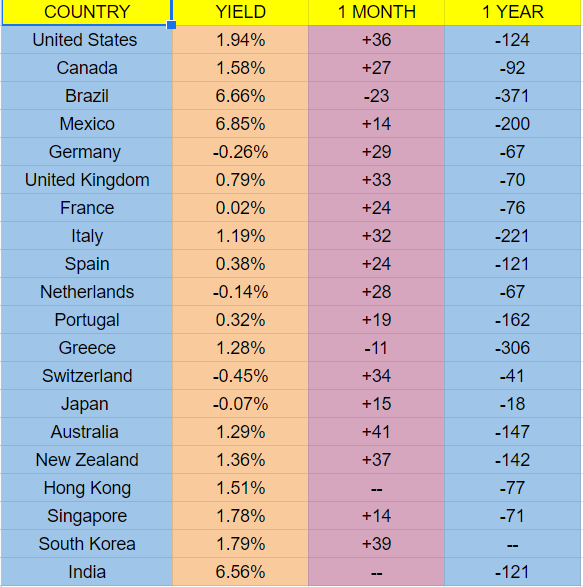

If you look at the basket of government yields below I think 1.94% 10year yield for the USA is a superb 'cash plus' option rather than something like the French 10 year at 0.02%. Plus I get USD weighting in portfolios for free while getting a return on cash.

I will leave it at that as the boiler man has just turned up. Winter is here Jon Snow.

As a final note I am thinking of buying some wheat forward contracts for my commodity account. I have many farmer friends and they all tell me to a man that the recent terrible weather is probably going to cause havoc with supply next year.

Best

Don 'yield' King