Natural Gas - Open water swimming gave me an idea

Dear Reader,

Human beings are an irrational lot. I have one friend, who shall rename nameless, who likes to keep 1.4 million euros in his current account just because he likes to look at it. I pointed out he might as well take 42,000 euros each year and burn it in a bin (3% inflation) and he agrees but he still likes to look at it. I have many people I talk to who are like this - the hard job for me is trying to get them to do something with it.

I like to think of myself as some kind of ginger 'money whisperer'. For me it has to move, do something, rather than just sitting on deposit somewhere. I always use this analogy . If you left 5 grand sitting on a table for a year and went back after 5 years it would still just be 5k. If you managed to get 5% returns (which frankly a drunk blind monkey could get you with the right asset allocation) you would have 6381 quid. I am not a rocket scientist but I think 6,381 sounds better than 5,000.

As I repeatedly say key to returns are diversification of risk. That even applies to diversification of concentration of money. If you leave 1 million in one account and that bank goes bust you are going to be lucky to see 10% back thanks to the European Commission's deposit guarantee schemes. So at the very least if you just want to look at your money keep it in several different accounts please.

Anyway I am not here to moan about clients. I wanted to talk about Natural Gas. As I have said before I like to have a footprint in commodities (small long or short positions) as it keeps my eye in on what is happening in those markets. I got an absolute shoeing earlier in the year as Natural Gas dislocated completely from WTI/Crude and fell off a cliff. I closed all my positions on it at 2.48 and went off to lick my like some wounded financial lion who had been roughed up by some dodgy hyenas. I will say that the losses on it were covered by the gains on gold.

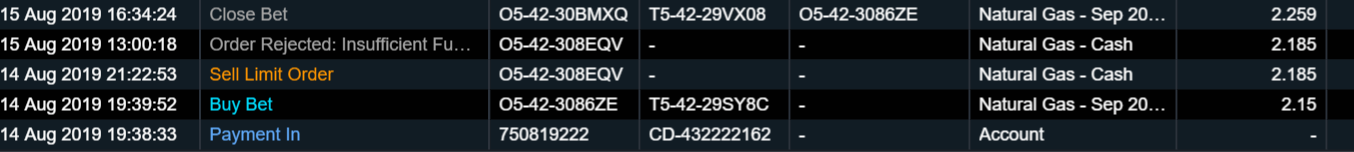

Anyway I cast a jaundiced eye on it last week and it was trading around 2.15. In commodities I adopt a 'trading places' approach to being involved. I do a lot of open water swimming and have noticed it is already getting colder so on the back of that I bought some Sep contracts CFDs through CMC at 2.15 on the 14th.

Imagine my shock when 24 hours later it was 2.26. If only every trade went this way.

As of writing it is now trading on CMC at 2.21 and was as low as 2.15 yesterday. I think I will start scaled back buying as we head into autumn as I think there is potential for upside.

This is not any form of investment advice and CFD's are certainly not an instrument for the every day investor as your risk return is much more highly geared. I just wanted to point out that I see value in NatGas at these levels.

Is it time to put the heating on yet?

Best

Don