Terribilis est mensis - Looking for Value is very like a game of rugby in the mud

Dear Reader,

I am a big fan of the Mikado. I think it was the first operetta I went to see in Inverness. Operetta is like opera but without all the rubbish shouty bits and I highly recommend it if you havent seen yet.

In the Mikado there is a song called 'There is beauty in the bellow of the blast' which says even terrible things can be beautiful. It could easily describe these current markets. Some fund managers must be tearing their hair out. The headlines are all about the impending doom and recession and negatively yielding bonds are everywhere you look. For light entertainment here is a link to the song in question.

https://www.youtube.com/watch?v=fJV90bg9zps

It is certainly not pretty right now. Markets aren't pretty things. They are often like a post match photo of two unfriendly rugby teams who have played 80 bruising minutes in the mud and rain. The question is how to find value in the storm.

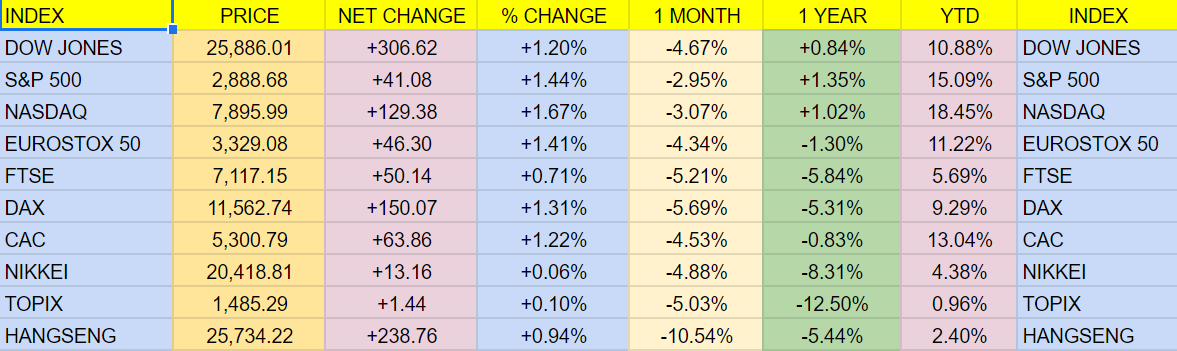

As I pointed out some time back the long S&P vs short the CAC looked like a decent trade. It has continued to move that way and there may be some more juice left in it.

Japan continues to have a shocker. Fundamentally things are looking a bit chirpier for them as their GDP and inflation are going in the right direction. That remains to be reflected in their markets performance. It perplexes me and certainly something worth watching.

I think we should start looking at the FTSE vs Eurostoxx 50. A point to remember is that over 70% of earnings by FTSE companies is earned outside the UK. With the recent sell off in the currency because of Carney's 'Amazing Cabaret of Project Fear' their reported earnings down the line should be positively impacted. I will take a spread reference of 5.53 and expect that to narrow in the next 6 months.

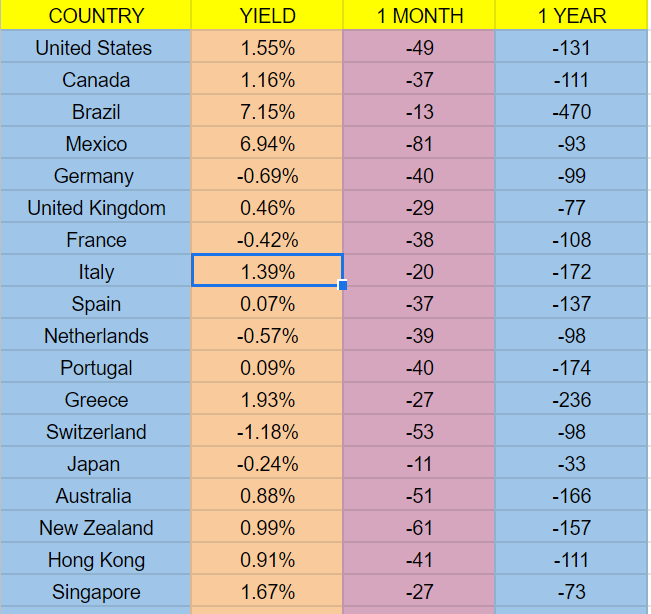

In government bond land insanity continues to rule. Portugal is set to go negative. A lot of media pundits will cry that this is the new normal. I am staying firmly out of it.

The rumour mill is grinding out stories that the Fed is actively considering issuing 50 and 100 year bonds on the back of the success of second issue of the Austria 100 year bond. In June they issued a second tranche at 1.71% and is bid to old boots apparently yielding around 0.77%. I am a bond guy (no not like a spy in a dinner jacket or some evil villain stroking a cat) and I can see that this is utter insanity. Who wants to take a 100 year bet with me that bet that the world is going to remain safe? If you do I have some magic sand I can sell you.

If they do issue these bonds I highly recommend you try and get an allocation as a short term flip trade as they will fly off the shelves like the latest children's toy at Christmas. Bond managers are looking for yield anywhere.

China is a tough one. I want to have funds exposure but I am not sure if it is the right time just now. A good friend of mine who runs 5 billion in EM portfolio risk always says he has to price in a 'bullshit data' margin when pricing that market. I will just stand on the edge of the dance floor for now I think.

Anyway. It is not raining for a change so I am off out on the bike. Great weekend to all

Don