The cost of a full english in Corfu has gone up! We are all doomed

Dear Reader,

Hooray for holidays!

I wanted to talk to you today about foreign exchange given the recent leg down in GBP vs EUR. It may surprise you to know I have traded both G10 and EM currencies in my career (what hasn't he traded I hear you moan but at least he hasn't said anything about Swiss Toni yet).

As of today we see GBPEUR trading at 1.095. I fully expect that we will see 1.06 at least as we approach BREXIT unless the Blonde Biker manages to pull some deal out of his saddle bag. My reasons for thinking this is mainstream media is pro remain, our Canadian head of the Bank of England is staunchly pro remain and is likely to show little support for GBP in case of a sell off to show us we should have stayed where we were.

I don't watch terrestrial TV unless I can help it. I am not a fan of baking celebrities dancing on ice on a love island sharing one IQ. However I do sadly sometimes see the BBC news and catch them interview Marge from Ilford moaning about how her full english in Corfu is going to cost her much more this year 'cos the pahnd is losing its value and that the Post Office gave her rubbish rates for her holiday'. We are all doomed I tell you - quite how much the currency is going to move in 90 days I cant guess but lets say project fear is on the job.

Personally as an investor I don't give a monkeys what the pound does. As an advocate of diversification of risk I also maintain diversity of currency. My portfolios are a blend of USD, EUR and GBP (note no Japan!!) and I am insulated against currency fluctations even to the point of gaining if I get the macro call right.

As a funny aside to this main theme of the article. When I traded FX it tended to be quoted in pairs or odd names (GBP V USD was called Cable) and you would ask for 'Right Hand Sides' bids or 'Left hand sides' offers. Being an old bond guy this was a bit confusing but where it got much worse was when I traded with Asia. They always quoted it completely the other way around. I found myself constantly having to check with the Japanese what their lefts and rights actually meant. Monty python broking 101.

Anyway back to the subject at hand. Marge has a habit of getting her currency at the Post Office or even at the airport before she leaves. Marks and bleeding Spencer have now started advertising foreign currency services for goodness sake. All of these places have eye wateringly off market rates for the public.

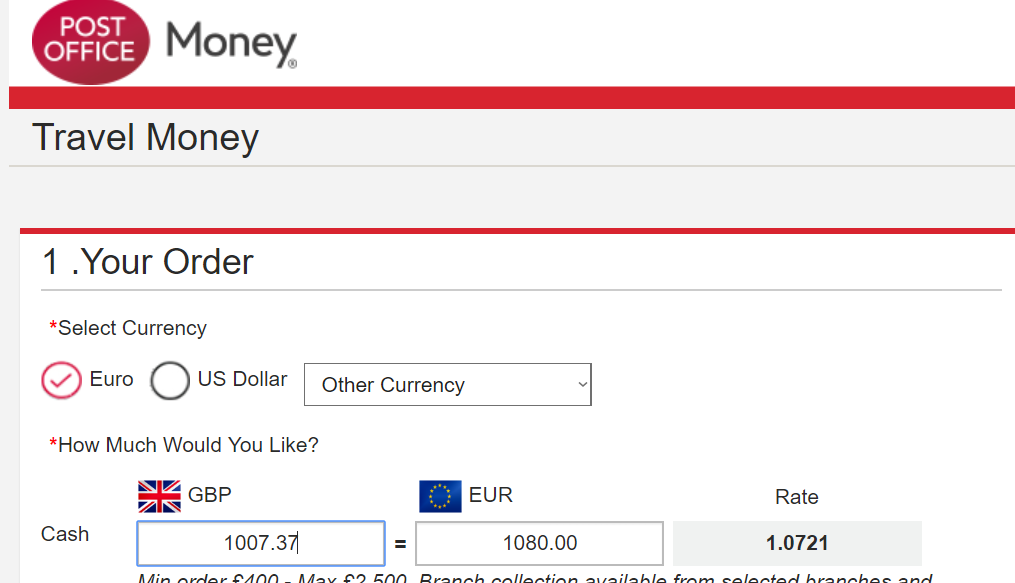

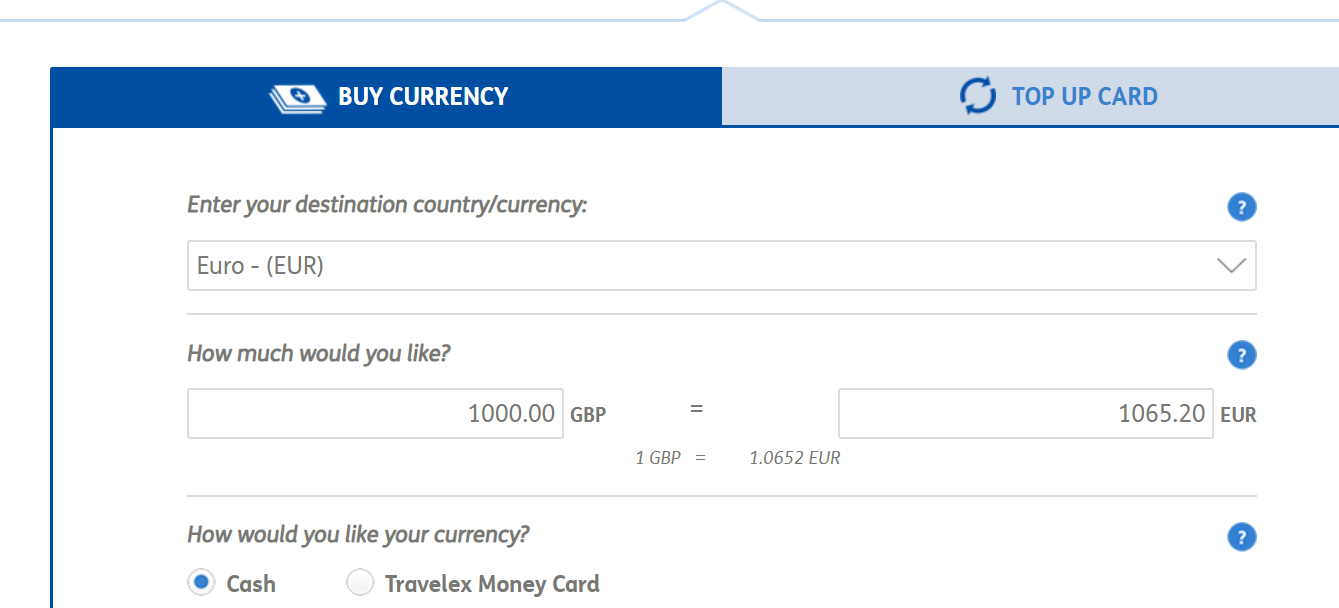

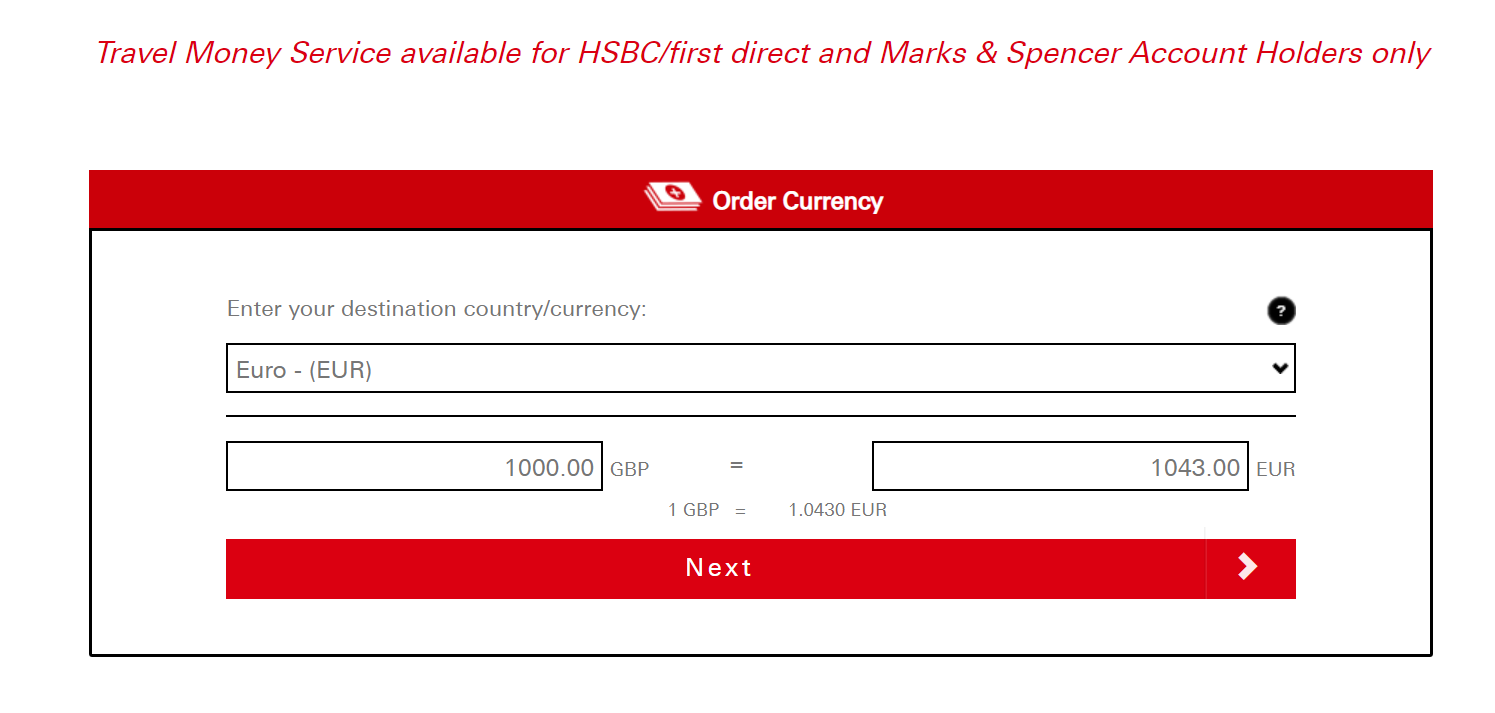

Some examples I have just taken from t'internet

Post Office +2.1% surcharge

Travelex 3% surchage

HSBC/marks and spencer 4.8% premium

They say that they don't charge commissions for providing an fx service. It is very easy to not charge when you are having people's eyes out for 4.8% of the nominal.

It gets even worse if you then return home and want to change any spare cash left over back. The bid offer spread can be as high as 10%.

Here are Don's handy pre brexit holiday hints to help save Marge money.

1/ DO NOT USE ANY OF THE ABOVE METHODS AT ALL

2/ at the very least use your normal bank card abroad but don't accept rates offered at the holes in the wall.

3/ Keep any remaining foreign currency as you will use it again in the future so why pay twice or three times to exchange

4/ Get a free card that you can load and get better rates on I use Centtrip as they provide the best rates and do not charge for the card.

https://insight.centtrip.com/lock-unlock-currency-card/

There are others like Revolut, Monzo that are similar. You just need to check if they have an initial cost for the card.

The key point is that anyone who thinks they are having to spend more money with a depreciating GBP in the short term has already probably wasted up to 5% of their money getting it exchanged before they even leave Britain.

That is it. It has been a very busy week with me driving all over the UK working on some other projects.I am thinking of reissuing the Proclaimers old hit as 'I would drive 1000 miles'. I am off out on the bike.

Have a great weekend.

Don left hand side King