Trading psychology - Its mental and about the depth of your pockets .. and cold water

Dear Reader,

I thought I would write a little about trading today. I have recently reentered the fray of Natural Gas markets and so far it seems to be great fun. As of this morning I am up 40.8% on my total nominal investment since the 14th of August 2019.

I write this with the extreme caveat that I have very small positions in commodities as I use them to keep an eye on those markets.

If you read one of my previous articles you will know I bought into Natural Gas contract because of swimming in a lake.

Traders are a fractious lot. Many will look for excuses to buy or sell then explain it away as reasoning for losing or gaining positions. I am about to dissect my trading strategy and you will see it is really nothing more than a gamble predicated on the fact some water was cold. It is as simple as that. Many fund managers will use statistics, stochastics and moving averages to show their expertise. They might as well flip a coin if they are short term trading.

14th Aug

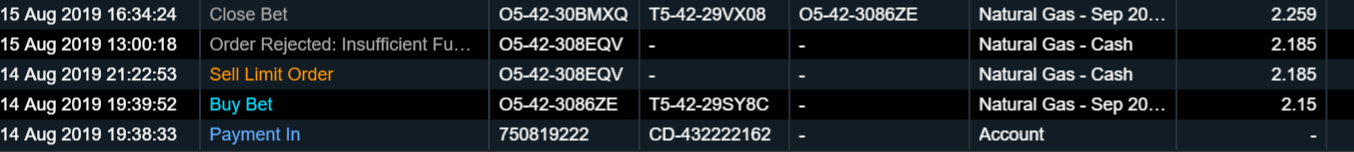

I bought and sold 2.15 - 2.259 which would have given me a nominal 5% gain but given I use CFD's which gear the trade 10x I ended up making 50% on my initial small investment.

20th Aug I decided to increase the investable money by 100% and started to buy. The market started to sell off but I scaled in as I had my view (because of cold water) that we would see a rally. Below you can see my buy points and what happened over the next few days - the trade worked.

From the 21st to the 23rd I had increased the nominal in my trading account to cover the downticks and allow me to build bigger positions. By the 23rd my account was 6 times the size of my original investment made on the 14th.

As the market rose I started to lock in profits and by the 26th was short again and up 24% on the new nominal total. I maintained the view that the market would rise because of cold water but why shouldn't I take advantage of short term fluctuations.

27th August - This is starting to look too easy

You can see how the market has moved and based on a simplistic personal belief I have manged to build a trading theory. On the 27th the account was now +35.4%.

28th August - Come on guys stop it!

You can see below where I went short on a spike up. If I am honest I had left a limit order to sell and forgotten about it and wanted to average in. All this still in the belief that the water was still cold and I think the market will go up as we go into Autumn.

As of writing this morning my account is up 40.8% (I bought back again at the close yesterday) and I am probably giving far too much attention to the market.

When you see traders tell you about option strategy or moving averages or any of the other myriad technical terms they really are just trying to justify a gamble. The gamble will be based on a reason. If the reason is sound then you have a fairly reasonable chance of being successful.

If I hadn't added to the account and merely cut my original positions as the market trended downwards then you could all point a finger and say 'look we told you so'.

To be successful as a trader in my view you need three things. Big pockets, brass balls and a good reason for the investment. Everything else is just a gamble. The other thing to remember is just because you are a buyer that should not stop you also being a seller if the conditions are right.

The water is still cold.

Thursday thoughts

Don 'gas' King