You have come a long way Baby... on target for 20% gains for the year

Fatboy Slim is a pretty decent DJ even for a bloke called Norman. Did you know he was the bassist in the Housemartins? His name came to mind when I was thinking of a catchy title to this morning's scribbling.

At the height of my City career I was a lofty 106 kilos. I am now 85.5 but have been as low as 78 in recent years. It is amazing the difference in every part of your life being more agile makes. It is hard to believe I managed to lose over a quarter of my entire body mass just through sport. To give you an idea I attach here a handy picture to give you the idea of the differences.

I often use this photo to remind me of doing little things often will have astounding results you probably couldn't imagine. Life is very like ironman triathlon (Oh god he is off again on one of his Swiss Toni tales I hear you cry)

Anyway today's article has nothing to do with my taste in natty salmon coloured tanktops. Although I must write the story of the day I wore that one day. It involves the Queen, a lock in in a back room at Swithins, some garden furniture and 13 city ne'er do wells and a tremendous amount of alcohol. That is for another day.

If you had asked me in December last year where I thought my portfolio was going to end up for the year I would have bet flat to plus 6%. Given where the indices were then that would have been a not bad performance to be honest. I had gotten a bit overexcited through to September last year as I seemed to be blowing the doors off right up until the point everything fell off a cliff.

Forward to today and most of my macro ducks seem to be lining up in a row.

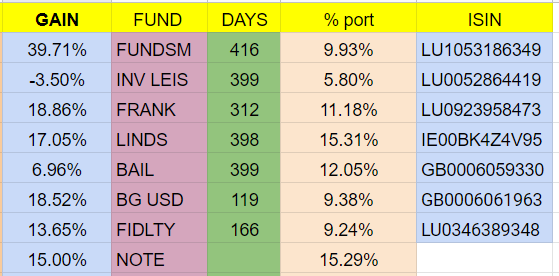

The stellar performance apart from Fundsmith in my opinion was my decision to heavily overweight USD funds. In fund manager school they apparently teach you that anything over 18% is 'overweight' in USD land. I currently have 36.4% weightings in USD. I have a nominal gain as of this morning of 8.5% on the currency which has given me 3% gains on my total portfolio!

I am over the moon with the macro play I have been promoting for over a year. As will be my clients as they joined me for the ride. The Orange swan rollercoaster continues.

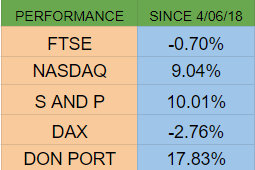

I hear you say 'but Don a drunk blind monkey with a blindfold and a dartboard could have made money last year'. This is possibly true and I have seen some blind monkeys who could do a better job than some fund managers if I am being honest. It is always important to refer performances to its peers and I do this by tracking the indices against my portfolios from the date of investment... see below.

How is that FTSE tracker looking now? My average holding is 316 days and if we track out I will be on target for 20.62% for a year. Year to date from january that increases massively to 31%.

It is very important to focus on the trees as well as the wood for investing. I am more than happy to talk to anyone interested in this sort of stuff. As a disclaimer the value of funds do go up as well as down as we know from the last quarter of 2018.

I am trying to consider the next moves but apart from buying a lot of bacon on the back of the news that half of China's pigs have died from Pig Ebola all I can think is in investing terms that we have left the Mallory step and are pushing on to new highs. Barring black swans (Iran) we should carry on in a positive trend into an election year. Ask yourself the question - will the Orange swan want stronger or weaker markets? I think we all know the answer to that.

Happy hunting

Don